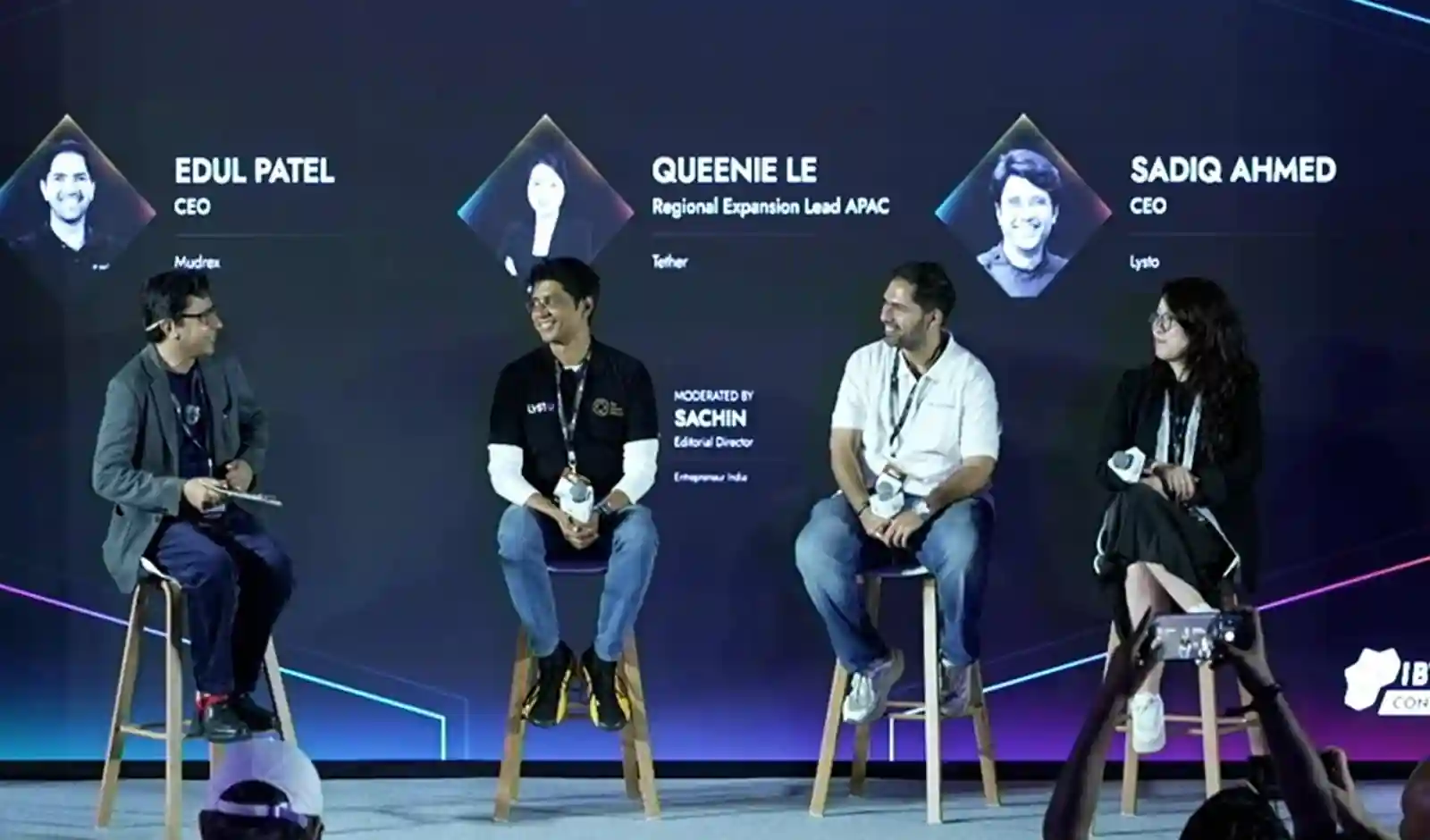

At the recently concluded India Blockchain Week 2025, a session titled "Stablecoins in Everyday Life: From On-Ramp to Real World Usage" brought in leaders from Tether, Mudrex, and Lysto to discuss how stablecoins are rapidly moving from a speculative crypto tool to a mainstream financial rail.

Moderated by Sachin Marya, Editorial Director at Entrepreneur India & APAC, the conversation explored institutional adoption, remittances, gaming, and the ever-evolving regulatory architecture around the world.

Opening the discussion, Marya positioned stablecoins as a maturing technology. "What I've studied about it is it's moving from an on-ramp crypto to a highway… everything from an everyday essential to remittances globally to probably the digital e-commerce that's going to take place. Stablecoins are going to make a huge impact there."

As of late 2025, the global stablecoin market has surged past USD 300 billion in total market capitalization, an expansion that underscores how stablecoins have grown beyond their niche crypto tools into a major rail for global money. Supply-wise, stablecoins rose from approximately USD 138 billion in February 2024 to USD 225 billion by February 2025, marking a 63 per cent year-on-year increase, according to a report by TradingView.

Over the same period, monthly stablecoin transfer volume more than doubled, from approximately USD 1.9 trillion to USD 4.1 trillion, indicating growth in transactions, remittance flows, and financial service activity.

Meanwhile, active stablecoin wallet addresses climbed from 19.6 million in February 2024 to around 30 million by February 2025, a 53 per increase according to a report by The Coin Republic.

USDT's Expanding Global Footprint

Representing Tether, Regional Expansion Lead (APAC) Quynh Le highlighted the scale and organic spread of USDT across markets. "Tether is the largest stablecoin issuer of USDT in the world. Currently, we have more than 500 million users globally, and the market cap is around 185 billion dollars."

She noted that USDT often enters markets before the company formally does, and described stablecoin adoption in emerging markets as increasingly driven by real utility rather than speculation. According to Le, According to her, USDT has become critical for trade settlement, liquidity, and now, an expanding set of real-world financial use cases, from remittances to supply chain finance to future tokenization layers.

Importantly, regulatory clarity is accelerating institutional interest. "You mentioned about Genius Act, you mentioned MECA, different regulatory frameworks have been developed across the globe recently. You will hear a lot of buzzwords around stablecoin, not because it's trending, but because it really brings the real-world use case."

The Remittance Revolution

To Mudrex co-founder and CEO Edul Patel, stablecoins mark a structural transformation within financial services. "They fundamentally remove banking from a bank, and can help us offer a wide variety of financial services for much cheaper, much faster, without going through a wide variety of intermediaries."

Patel illustrated how cross-border payments, historically slow and expensive, are being reshaped. "The money moves near instantly. It's almost like doing UPI but across countries. And at the same time, the costs are significantly cheaper, traditional banking rail would cost you 3–5 per cent. Stablecoin-based payments are less than 10 basis points."

Importantly, regulatory clarity is accelerating institutional interest. "You mentioned about Genius Act, you mentioned MECA, different regulatory frameworks have been developed across the globe recently. You will hear a lot of buzzwords around stablecoin, not because it's trending, but because it really brings the real-world use case."

The Remittance Revolution

To Mudrex co-founder and CEO Edul Patel, stablecoins mark a structural transformation within financial services. "They fundamentally remove banking from a bank, and can help us offer a wide variety of financial services for much cheaper, much faster, without going through a wide variety of intermediaries."

Patel illustrated how cross-border payments, historically slow and expensive, are being reshaped. "The money moves near instantly. It's almost like doing UPI but across countries. And at the same time, the costs are significantly cheaper, traditional banking rail would cost you 3–5 per cent. Stablecoin-based payments are less than 10 basis points."

"The goal here is to launch a stablecoin that is very customized for the needs of the gaming industry, influencers, developers, pay-ins, and pay-outs. Gaming is inherently global in nature, and hence, the movement of money should be seamless within a game, outside the game economy."

Ahamed added that stablecoins are already widely used informally by gaming firms to pay creators and contractors across borders, opining that the introduction of a purpose-built "gaming dollar" formalizes this behaviour.

Regulation: From Uncertainty to Structured Dialogue

Ahamed said, "When Quicksilver was started, the regulatory environment was hazy. Eventually, there came what we call as prepaid issuer format now. It's very similar, even today, stablecoins are in a stage where there is some regulation and some not."

Patel added that regulation must be contextual, not copy-pasted. "Aligning the interests of users, of the nation, as well as what the technology can potentially offer, is a combination that changes from country to country, just because the US has a regulation and India should adopt the same: that approach will definitely not work."

Sachin observed that global regulators are increasingly approaching stablecoins from a "need-case lens" rather than as a threat, something that opens the door to more constructive policymaking.

The Road Ahead

As Stablecoins expand across remittances, gaming, trade, finance, and tokenised assets, panelists were unanimous about mainstream usage being no longer hypothetical and happening in real time.

Quynh Nhi concluded with Tether's expansion priorities: "We feel like we can really add more value, especially for the unbanked and underbanked population, 3 billion people categorized unbanked and underbanked, that's why we come in and help add value."

This article was originally published by the

This article was originally published by the