Jewellery brand Palmonas, co-founded by actress Shraddha Kapoor, is in advanced discussions to raise ₹200–250 crore from mid-market private-equity firm Xponentia Capital, according to media reports.

The funding round, if finalised, would place Palmonas at a post-money valuation of around ₹1,600–1,800 crore, more than triple its valuation in its most recent raise.

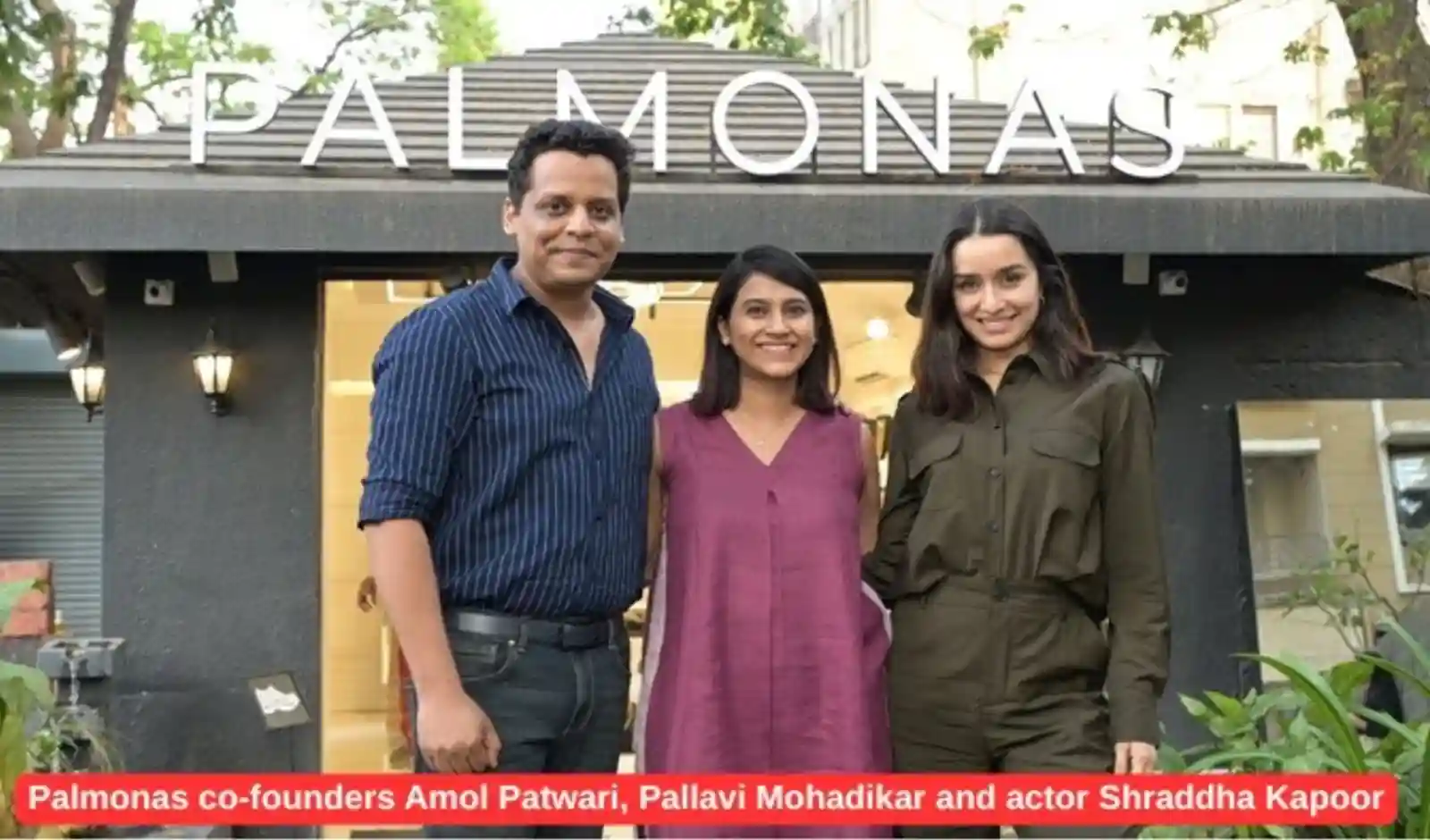

Palmonas had previously raised ₹55 crore earlier this year in a Series A led by Vertex Ventures Southeast Asia & India at a valuation of approximately ₹500–550 crore. The brand—launched in 2022 by partners Amol Patwari and Pallavi Mohadikar—currently tracks an annualised revenue run-rate of about ₹300 crore.

The proposed capital injection would fuel Palmonas aggressive rollout plans across online and offline channels, and strengthen its position in the fast-growing “demi-fine” jewellery segment. The brand, known for stainless-steel and sterling-silver jewellery coated with 18 K gold vermeil, sells via D2C channels and is scaling its physical store footprint.

An investor quoted in the sources says the funding environment is favouring jewellery players as they look to build inventory and scale ahead of key demand peaks such as Valentine’s Day. Neither Palmonas nor Xponentia has publicly commented on the transaction. The deal remains subject to due diligence and final board approvals.

If successful, the round would mark one of the larger private-equity deals in India’s jewellery start-up space this year, underscoring the growing investor appetite for new-age brands challenging legacy jewellers.

This article was originally published by the Franchiseindia.com. To read the full version, visit here

This article was originally published by the Franchiseindia.com. To read the full version, visit here